Bi-generational homes, also called intergenerational homes, have gained popularity in Quebec in recent years.

These homes are designed to accommodate two generations under one roof, while offering them independent and suitable living spaces.

They represent an attractive solution for families looking to grow closer, share living costs and help each other.

What is a multigenerational home?

A multi-generational home is a type of housing that includes two separate residential units within a single house. One unit is typically smaller and designed to be self-contained, with its own entrance, kitchen, bathroom, and living space.

The concept is particularly appreciated for its flexibility, sustainability, and inclusiveness. It allows families to live together while preserving the independence of each generation.

Prices of bi-generation homes in Quebec

The price of bi-generational homes in Quebec can vary considerably depending on several factors, including location, size, condition of the home, quality of construction, and other factors specific to the real estate market.

On average, in 2023, the price of a bi-generational home in Quebec can be expected to be around 400,000 to 600,000 $. However, in more rural areas, bi-generational homes can be found for as little as 250,000 $, while in urban areas like Montreal, prices can easily exceed one million dollars.

Profitability of a bigenerational house

Beyond the initial cost, it's important to consider the cost-effectiveness of a multi-generational home. By sharing the costs of the mortgage, utilities, maintenance, and other ongoing expenses, significant savings can be achieved.

Additionally, the presence of a second generation can provide valuable support, such as help with childcare or elder care.

Legal and regulatory considerations

It is also important to note that the purchase or construction of a multi-generational home is subject to specific regulations.

For example, some municipalities may have restrictions on the size or location of multi-generational homes, so it's crucial to check with local authorities before embarking on such a project.

Two-generation house – Special features

When it comes to multi-generational homes, the issue of property tax and how it is calculated can be a bit complex. It depends on how the home is structured and recognized by the municipality.

A single address

If the multi-generational house has a single address, this generally means that it is considered a single entity by the municipality.

In this case, you will receive a single tax bill for the property, which will be calculated based on the total value of the home.

However, as I myself own a multi-generational home with an address in Trois-Rivières, certain taxes have to be paid twice.

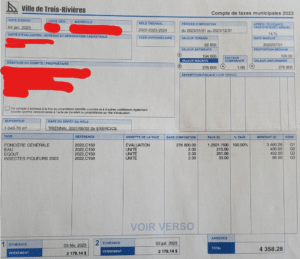

Based on my 2023 tax bill, I paid water, sewer, and biting insect taxes twice on my municipal tax bill.

As for property tax, I pay it only once on the total value of the house (main house + apartment). Property tax is not separated between the house and the apartment since the house is considered a single dwelling.

Here, as an example, is my 2023 tax bill for my multi-generational home:

Also, when the multi-generational home has a single address, this can simplify certain tax issues, such as the application of the capital gains exemption for primary residences.

In any case, it is strongly recommended that you consult a tax or real estate expert to understand the tax implications specific to your situation.

Two addresses

In the case of a multi-generational home with two separate civic addresses, the municipality may issue two tax bills for each part of the home. Each tax bill will be calculated based on the assessed value of the respective part of the property and the municipal services provided to each unit.

However, property tax regulations may vary depending on the municipality where you live. Some municipalities may consider the property as a single lot and therefore issue only one property tax bill for the property. Therefore, it is important to check the property tax rules and regulations with your municipality before purchasing or building a multi-generational home with two street addresses.

Additionally, the legal status of each unit in the multi-generational home could impact how tax bills are issued. If each unit has a separate civic address and is registered with the municipality as a separate housing unit, this could facilitate the issuance of two separate property tax bills. However, if both units are registered as a single housing unit, this could complicate the issuance of two separate property tax bills.

Each property may be eligible for its own capital gains exemption, provided each unit is owned and occupied by a separate owner.

However, if only one generation owns the property, the capital gains exemption may only apply to part of the residence.

In summary, it is important to understand the property tax rules and regulations in your municipality before building or purchasing a multi-generational home with two separate street addresses.

Again, it is strongly recommended that you consult your local council or a real estate expert for specific information on property taxation for multi-generational homes in your area.

Other considerations

It's important to note that while splitting property taxes into two bills may seem more expensive at first glance, it can actually offer some benefits. For example, if part of the house is rented out, it could make it easier to deduct rental expenses on your taxes.

On the other hand, it is also important to note that dividing a property in two may incur additional costs, such as permit fees or fees to have the property appraised.

Who manufactures bi-generational houses?

In Quebec, several companies offer models of two-generation houses, whether in standard construction or prefabricated

Here is 5 manufacturers for a two-generation house project:

Manufactured homes Side: This Quebec-based company offers prefabricated intergenerational home designs. Their modular approach allows for significant customization and high-quality construction.

Maisons Laprise: Another leader in the manufactured home field, Maisons Laprise offers custom plans for intergenerational homes.

Pro-Fab Group: This modular home builder offers intergenerational options among its prefabricated home models.

Drummond Drawings: Dessins Drummond is a leader in house plan design in Quebec and the rest of Canada. They offer a variety of plans for intergenerational homes that can be adapted to your specific needs. These plans can then be used by the builder of your choice to complete the construction.

Beaubois Constructions: Based in Quebec, Constructions Beaubois is a family business specializing in the construction of custom residential homes, including intergenerational homes. Their expertise and personalized approach allow them to meet the specific needs of each family.

Two-generation house model, builders and prices!

| Company | Model |

Price ($) |

Area (Pi^2) |

Link |

| Côté Manufactured Homes | Ë2B

intergeneration |

250 000 | 1590 | https://www.maisonsusineescote.com/fr/modeles/e2b-intergeneration/ |

| Maisons Laprise | 3046 | 349 812 | 2729 | https://www.maisonlaprise.com/3046/ |

| Pro-fab | Kawa | – | 1726 | https://www.profab.ca/construction/kawa/ |

| Drummond Drawings | Root | 417 000 | 2931 | https://dessinsdrummond.com/plan/racine-chalet-1003347 |

| Beaubois Constructions | Contemporary | – | 1935 | https://constructionsbeaubois.com/modeles/bi-generation/ |

*Price does not include taxes.